Canadians Selling on Amazon [2021 Report]

Amazon continues to grow every year and so do its sellers. We’ve surveyed 82 Canadian third-party sellers, and this report summarizes the most important information we’ve gathered from the study.

Highlight Insights

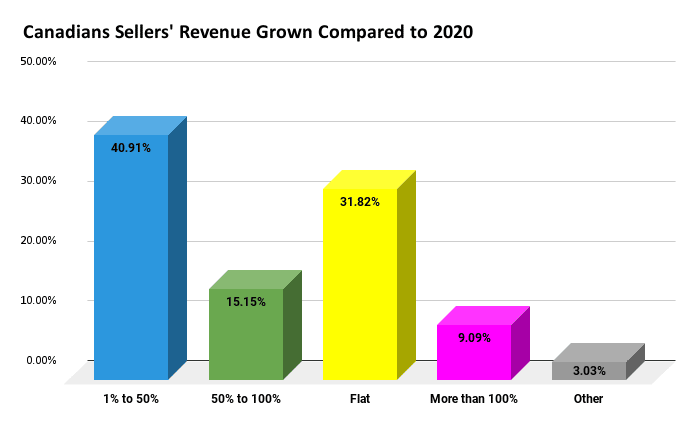

- Canadian Amazon Sellers Got a Revenue Boost in 2021. Based on our study, 65.15% of Canadians selling on Amazon said their revenue increased from 2020 to 2021, despite the global supply chain crisis and the COVID-19 pandemic.

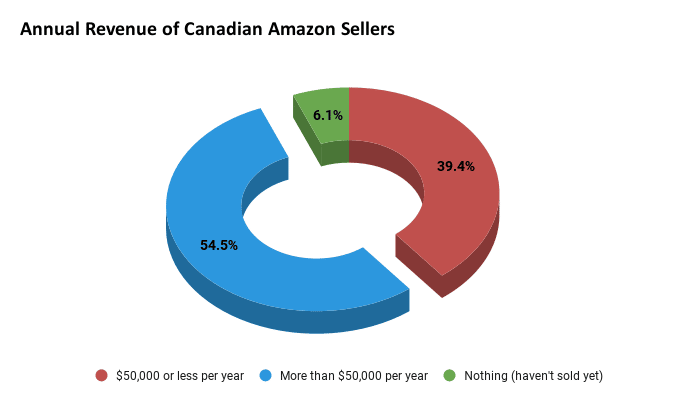

- More Than Half of Canadians Selling on Amazon Reached More Than $50K in Annual Revenue. About 54.5% of sellers said that their approximate annual revenue is more than $50,000 per year, while 6.1% said they haven’t sold anything yet.

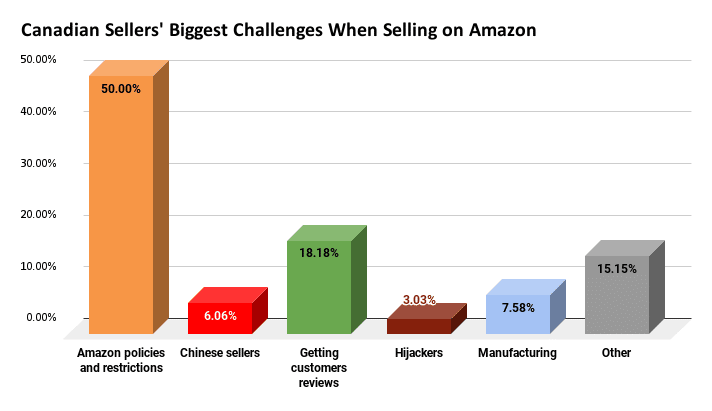

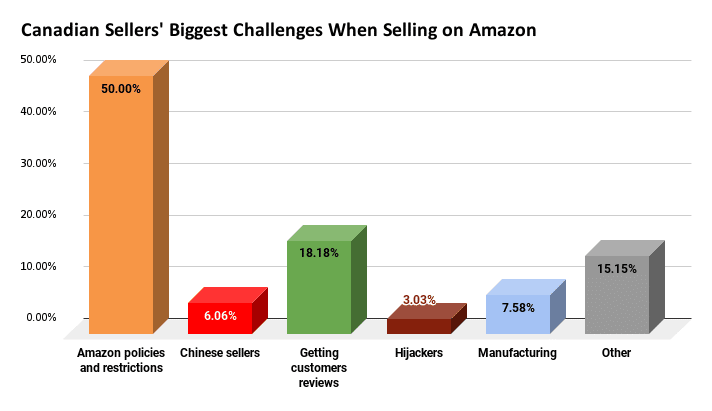

- Most Sellers Think Amazon's Policies and Restrictions Is Their Biggest Challenge. Half of the sellers we surveyed are more concerned about Amazon’s policies and restrictions interfering with seller growth compared to possible hijacking and competition from Chinese sellers.

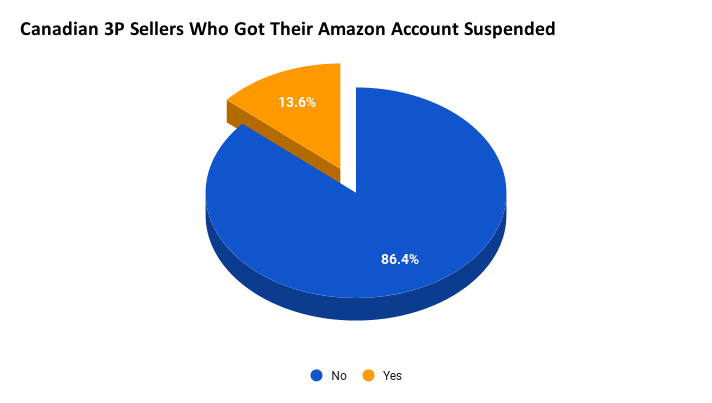

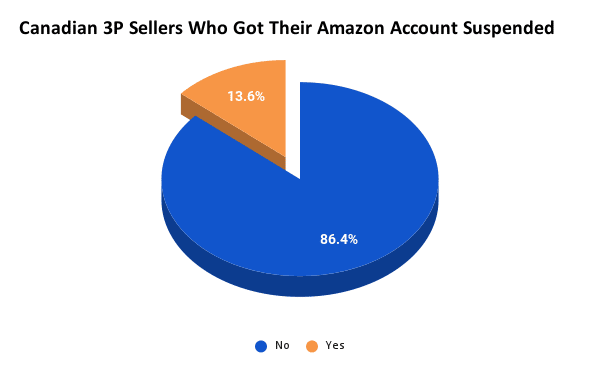

- One-seventh of Canadian Sellers Had Their Amazon Account Suspended. About 13.6% of Canadian sellers said they had their Amazon account suspended over a contentious new shipping policy, a situation that highlights growing tensions between the e-commerce giant and the small-business community.

Contents

- Methodology: How We Collected the Data

- Ecommerce Landscape in 2021

- The Profile of a Canadian Amazon Seller: Demographics

- Canadian Amazon Sellers and Their Type of Business

- How Canadians are Driving Traffic From Off Amazon Sources

- The Challenges of Selling on Amazon in 2021 as a Canadian

- Canadian Amazon Sellers Got a Boost in Their Annual Revenue Compared to 2020

How We Collected the Data

Between October 6th and November 30th, 2021, EcomCrew surveyed 82 Canadian Amazon sellers who sell on Amazon and who have at least one product listing live on the platform.

The respondents are all based in Canada and they may sell in any or all of the Amazon marketplaces and in any or all of the categories listed on Amazon. They are of all genders and are 18 to more than 65 years old.

The Ecommerce Landscape in 2021

January 2021

- Amazon reports revenue growth of 38% more than the previous year.

February 2021

- Uncle Jeff announces he will be stepping down as CEO of Amazon in Q3.

- Amazon rolls out the FBA New Selection Program, which gives free monthly storage fees for 90 days, free returns processing, and other advantages.

- Amazon announces its referral and FBA fees updates for 2021, which will take effect in June.

- Amazon announces that starting March 10, it is no longer accepting new enrollments in the Early Reviewer Program and will stop offering the service to already enrolled sellers by April 25.

- The Ever Given, one of the world's largest container ships, gets stuck in the Suez Canal.

April 2021

- Sea freight rates soar 300%.

- Amazon announces new restock limit changes. FBA products are no longer subject to ASIN-level quantity limits. Instead, restock limits will be set at the storage-type level.

- Amazon rolls out a new program called Manage Your Customer Engagement, which allows sellers to send email marketing for new launches to customers.

May 2021

- Amazon sellers experience massive reductions in restock limits. Major cuts to restock limits overnight that went as high as 85% were seen.

June 2021

- New referral and FBA fees are implemented, starting June 1st.

- Amazon announces that Prime Day will be on June 21st and 22nd.

- Amazon ads are getting more expensive.

July 2021

- Andy Jassy becomes CEO of Amazon.

- Sellers are given the chance to contact customers who left a bad review.

- Amazon Canada announces it won’t have its Prime Day this year.

August 2021

- Recent floods in Western Europe and China hold up raw materials and products staged for peak shopping seasons like Black Friday and Christmas.

- Amazon lobbies sellers to avoid ending their private label brands.

- Amazon makes significant changes, requiring sellers to have product liability insurance.

- Amazon rolls out FBA Liquidations and FBA Grade and Resell.

September 2021

- Mass suspension of Chinese sellers

- Sellers are still reporting major cuts on top of the original unannounced reductions.

- Apple rolls out a new iOS that will make open rates unreliable.

- Amazon seller Chukar Cherries is banned for false links with Chinese sellers.

- Amazon makes significant changes to requiring sellers to have product liability insurance.

October 2021

- Amazon suspends RebateKey’s API privileges.

- Amazon requires free returns for seller-fulfilled fashion Items.

- A shortage in electricity sweeps much of eastern China, which is the country’s manufacturing hub and home to a lot of suppliers for ecommerce sellers.

- Amazon announces new programs and features in their annual event, Amazon Accelerate 2021.

- Amazon rolls out Product Opportunity Explorer.

November 2021

- Amazon officially announces that offering discounts and rebates outside of Amazon is against its TOS.

- Amazon updates eligibility requirements to the Small and Light Program.

- Cargo ships get stuck in US ports as the country’s infrastructure struggles to keep up with increasing import volumes.

- Amazon announces an increase in FBA for January 2022.

December 2021

- Amazon informs sellers of changes coming to its restock limits policy and the IPI thresholds for FBA storage limits.

- Amazon is accused of violating FTC rules with how they run their ads.

The Profile of a Canadian Amazon Seller

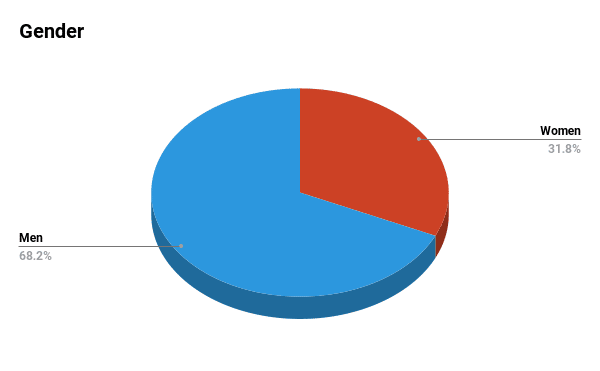

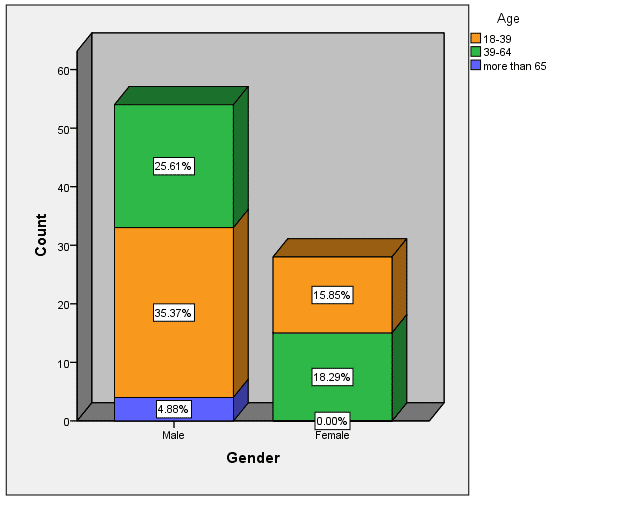

Nearly three-fourths of Canadian sellers on Amazon are male.

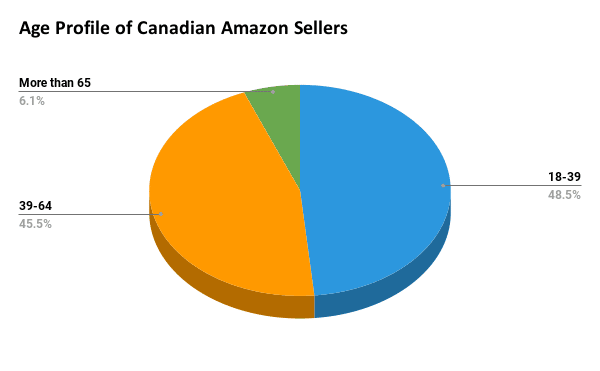

The majority of Canadians selling on Amazon are between 18 and 34 years old (48.5%), while 45.5% are between 39 and 64 years old.

Women make up 31.8% of Canadian Amazon sellers, the majority of which are between 39 and 64 years old. On the other hand, of the 68.2% who are men, 35.37% of them are between 18 and 39 years old. This means that men start an ecommerce business on Amazon at an earlier age than women.

Canadian Amazon Sellers and Their Type of Business

There are a handful of decisions to make when you decide to start selling on Amazon, such as what marketplaces to sell on, what fulfillment method to use, or what type of business to choose.

What Marketplaces Do Canadian Sellers Sell On?

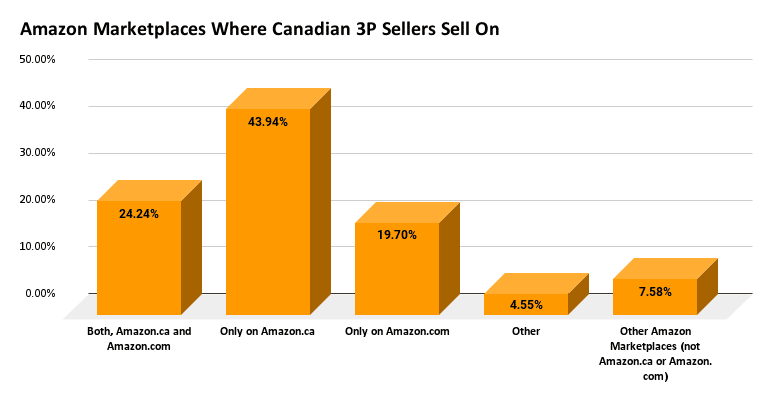

Based on the survey, 43.9% of Canadian sellers list their products only on Amazon.ca while 24.24% decided to sell on both Amazon.com and Amazon.ca.

So a significant percentage of Canadian Amazon sellers decided to not expand their businesses to other Amazon marketplaces in 2021.

However, there are a lot of advantages in selling on other marketplaces. The sales channels that arguably have the highest probability of earning the biggest growth for your ecommerce company are other Amazon marketplaces, specifically Amazon.com, Amazon.co.uk, and Amazon.de.

What Fulfillment Method Do Canadian Amazon Sellers Use?

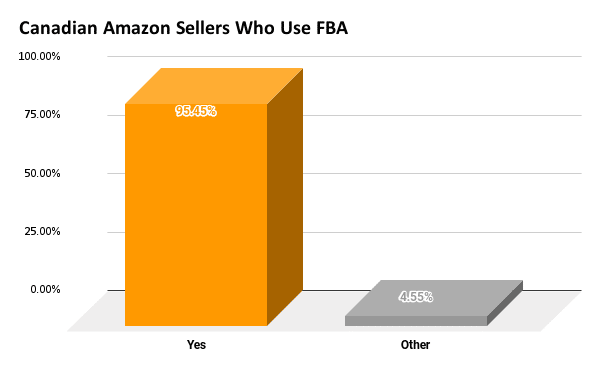

Despite the limitations of Amazon’s warehouses due to the pandemic in 2021, most Canadian third-party sellers (95.45%) said that they use Amazon FBA services.

Fulfillment by Amazon (FBA) means having Amazon store, pick, pack, and ship your orders out for you with corresponding fees and also with a few in-house features designed to streamline your selling experience.

| FBA vs. FBM: How does FBA differ from FBM? | ||

|---|---|---|

| FBA | FBM | |

| Prime Eligibility | Yes | No |

| Who handles customer concerns | Amazon Customer Service | Sellers |

| Shipping and handling | Amazon arrange shipping costs to customer and bills the sellers | Sellers deal with shipping and handling |

| Inbound shipping costs | Yes | None |

| Storage and fulfillment | Amazon takes care of storage and fulfillment, but sellers have to pay FBA fees | Sellers have to manage their warehouse or work with a 3PL |

| Returns | Amazon handles returns | Sellers have to deal with returns, refunds or other customer complaints. |

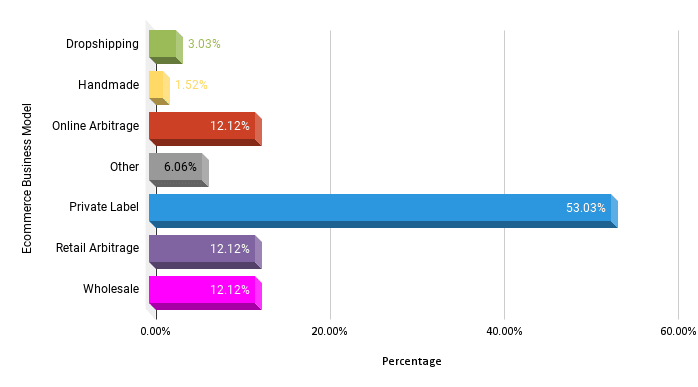

Amazon Business Models

Among Canadian sellers on Amazon, private labeling (53.03%) is the most popular sales model. This model requires more time and energy as sellers need to find a niche to build their ecommerce company around and then find products to develop. This is made more difficult by the fact that the ecommerce world is becoming more competitive, so you need to stand out from your competition in order to succeed.

Other types of ecommerce business systems are more beginner-friendly like retail arbitrage, online arbitrage, and wholesale.

Finding the Right Niche and Products

Finding great products to sell in the right niche is the key factor in running a successful Amazon FBA business.

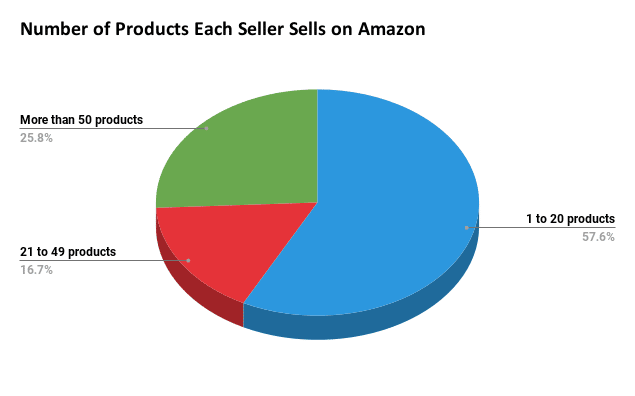

The majority of the Canadian sellers we surveyed (57.6%) sell between 1 and 20 products, and 25.8% have more than 50 products on Amazon.

Most successful Amazon sellers don't make a full-time income by selling just one product. They build and sell a catalogue with several different products.

For 54.5% of the sellers surveyed, the average annual revenue is more than $50,000 per year.

Finding the right niches and high-quality products lay the foundation for a successful ecommerce business with a fairly high income.

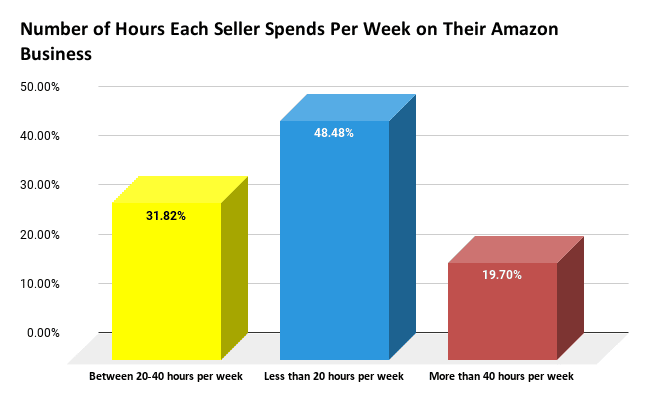

A significant percentage (48.48%) of those surveyed spend less than 20 hours each week on their Amazon business while 31.82% spend between 20 to 40 hours per week. Meanwhile, only about a fifth of them spend as much time on their business as a full-time employee would.

How Canadians Are Driving Traffic from Off-Amazon Sources

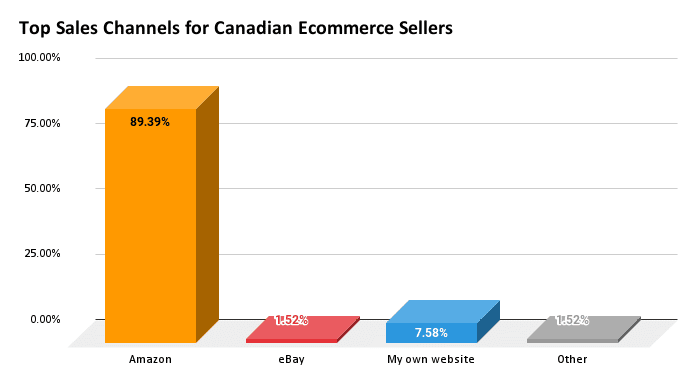

Definitely, Amazon is the place to sell for Canadian sellers who affirm that their top sales channel is the Everything Store (89.39%).

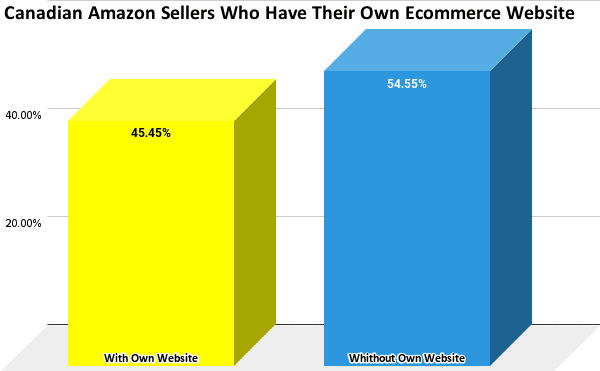

While 54.55% of Canadian sellers have their own ecommerce website, 45.45% don’t own one, despite the fact that having your own website can be used to boost your conversion rates on Amazon.

Other channels, like Walmart, are simply a bet on future growth. And finally, there are a number of niche-dependent sales channels like Etsy, Houzz, and eBay, which can result in very strong sales if your product assortment matches those channels’ target market.

Perks of Having an Ecommerce Website

- Helps establish credibility

- Supports your conversion rate

- Easy to set up

- Ability to ship the products using Amazon Multi-Channel Fulfillment

- Personalized pages for each brand

- Autonomy

- Cheap plans

The Challenges of Selling on Amazon as a Canadian

A lot of things were up in the air in 2021, especially for ecommerce sellers. From the massive increase in sea freight rates, the ever-changing Amazon restock limits, stricter privacy regulations that hurt targeted marketing campaigns, to the steadily increasing number of competitors looking to take advantage of the COVID ecommerce bump.

Half of Canadian Amazon sellers said that Amazon's policies and restrictions are their biggest challenge in growing their businesses.

Their second biggest challenge is getting customer reviews (18.18%). As we know, reviews are critical to a product’s success on Amazon. Ever since Amazon removed incentivized reviews, getting reviews has been harder and harder for Amazon sellers.

Another surprising data that we have found is that 13.6% of Canadian sellers said they had their Amazon account suspended. This situation highlights growing tensions between the e-commerce giant and the small-business community, since sometimes these suspensions are justified, but other times, they are not.

Canadian Amazon Sellers Got a Boost in Their Annual Revenue Compared to 2020

However, despite all the challenges that third-party sellers have suffered, the majority of Canadians who sell on this platform have reported that 2021 has been a better year in terms of revenue compared to 2020.

Only 31.82% of those surveyed said they did not experience any increase in revenue. However, more than half have seen an improvement compared to 2020, with 9.09% doubling.